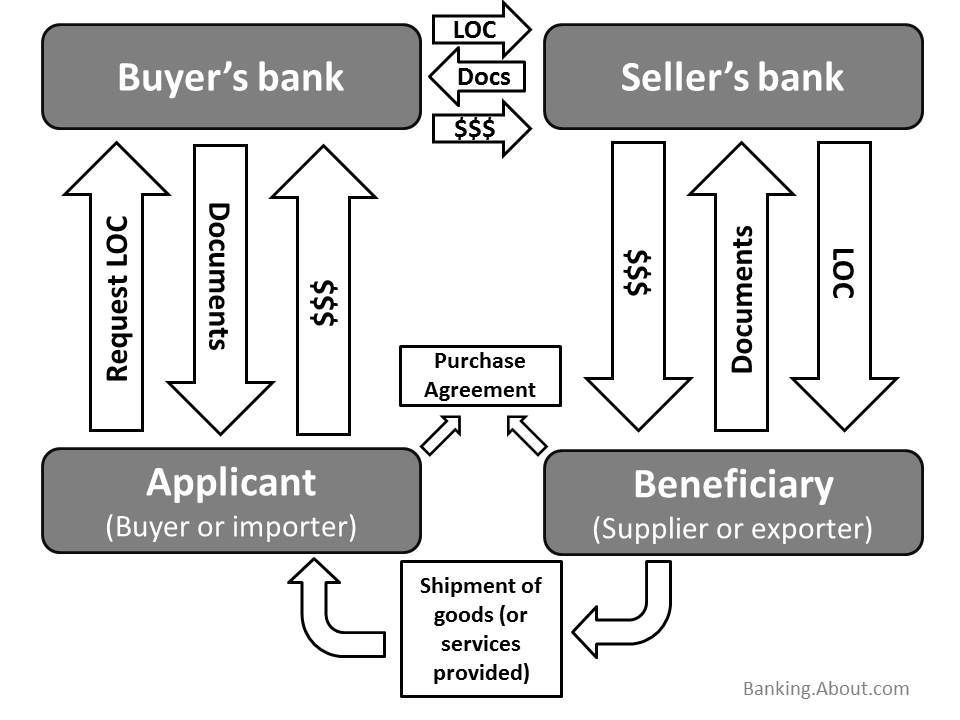

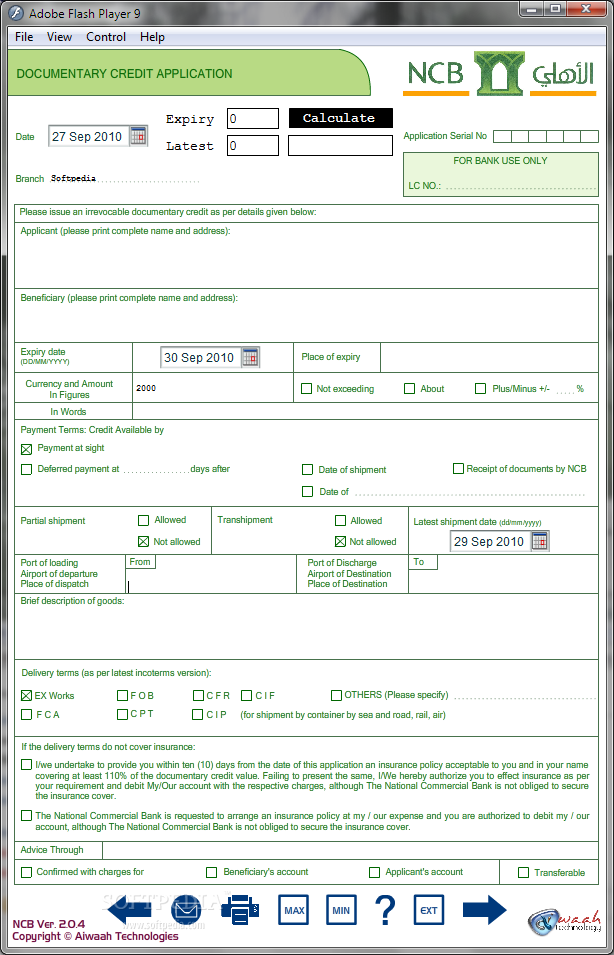

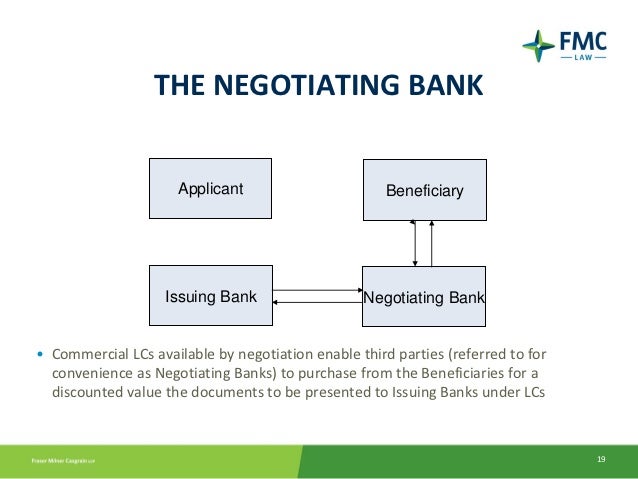

Negotiating Bank In Lc. The negotiation may be effected on a with or without recourse basis. Different from LC available by payment, LC available by negotiation allows the beneficiary to receive the payment by negotiating the sight drafts and documents at a nominated negotiating bank which is normally located in his country.

As with home loan modifications, it is easier to negotiate these types of secured For unsecured bank loans, use the same negotiation strategies as with credit cards.

Advising bank is beneficiary's Bank, can beneficiary send the documents to advising Bank (his own Bank ) for negotiation of Docs.

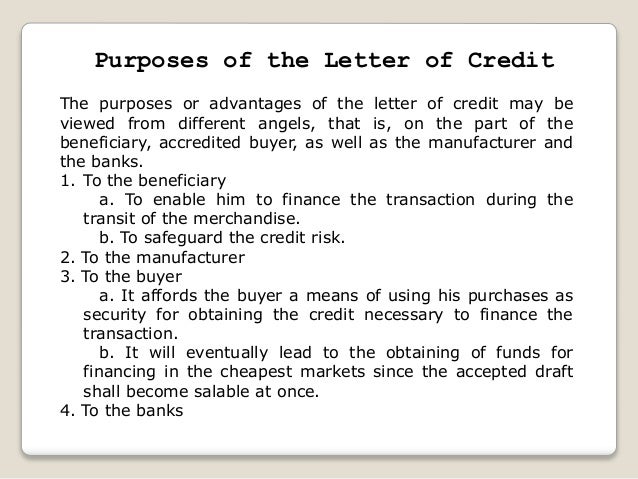

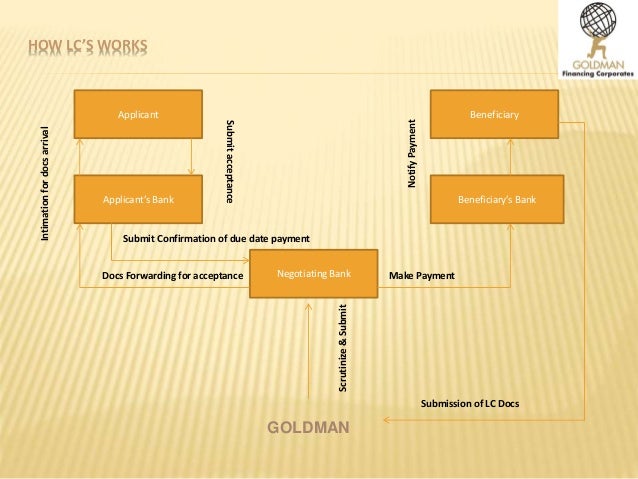

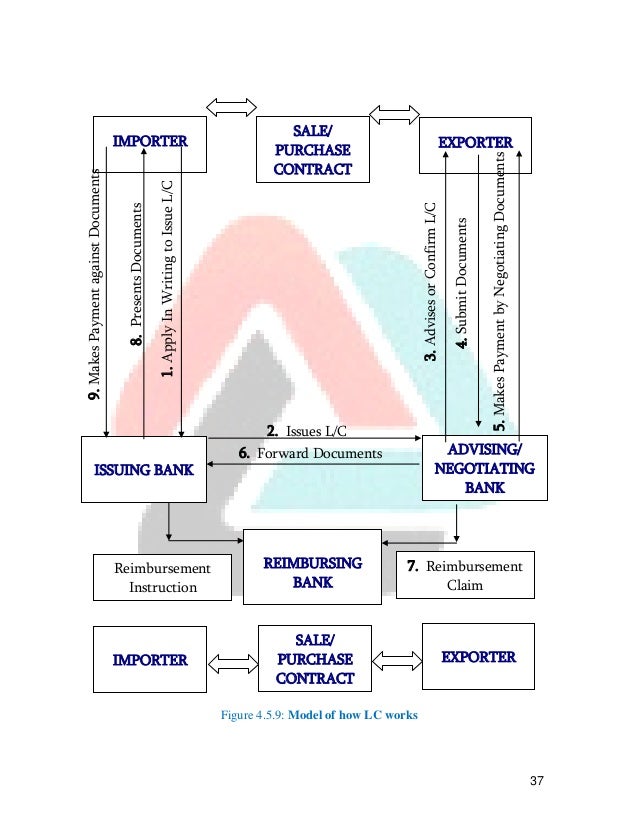

Confirmation of a Letter of Credit constitutes an undertaking on the part of the Confirming Bank, in addition to that of the Issuing Bank, to pay a customer, without recourse, if documents are presented in compliance with the terms and. Import LC is opened by the bank on behalf of its customer for the import of raw materials, capital machinery, consumer goods, food, chemicals, vehicles On submission of import documents, payment is made to the negotiating bank by debiting PAD A/c (payment against documents) in the name of. Following Banks are involved Issuing Bank,Advising Bank,Negotiating Bank.